Features

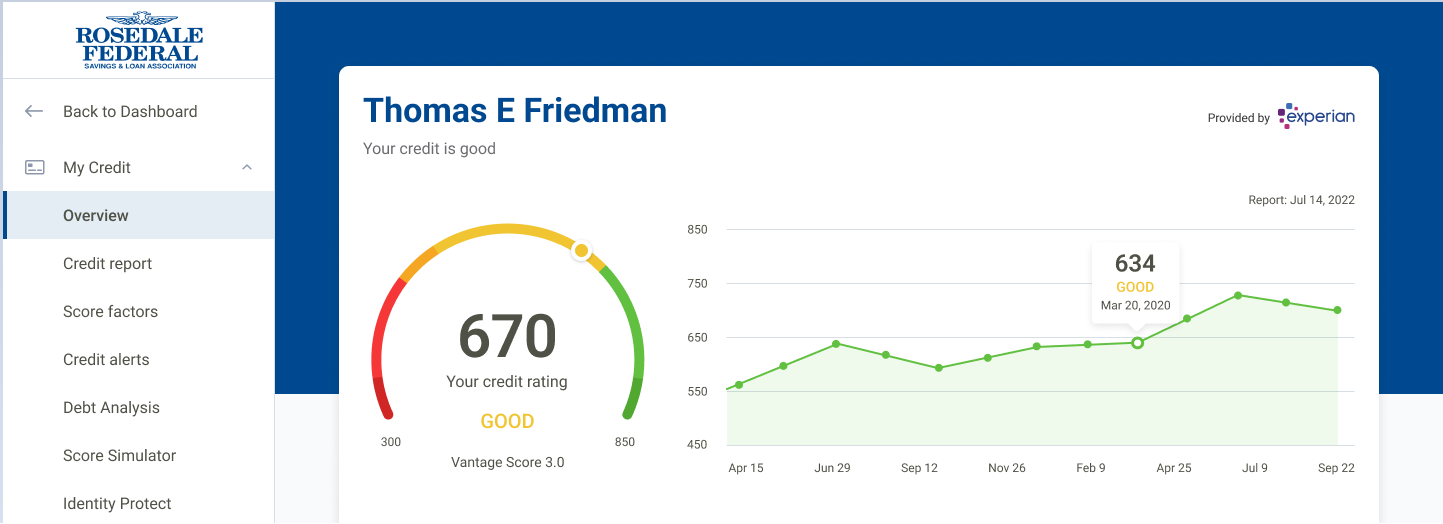

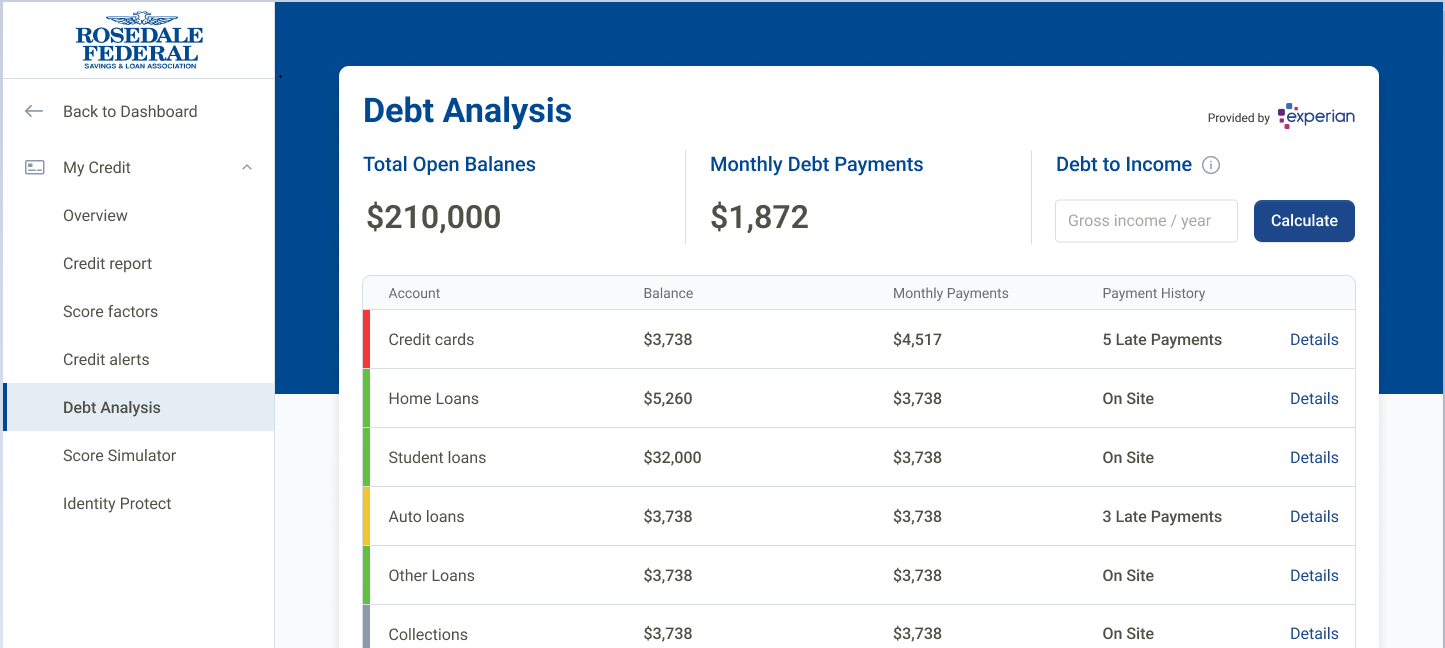

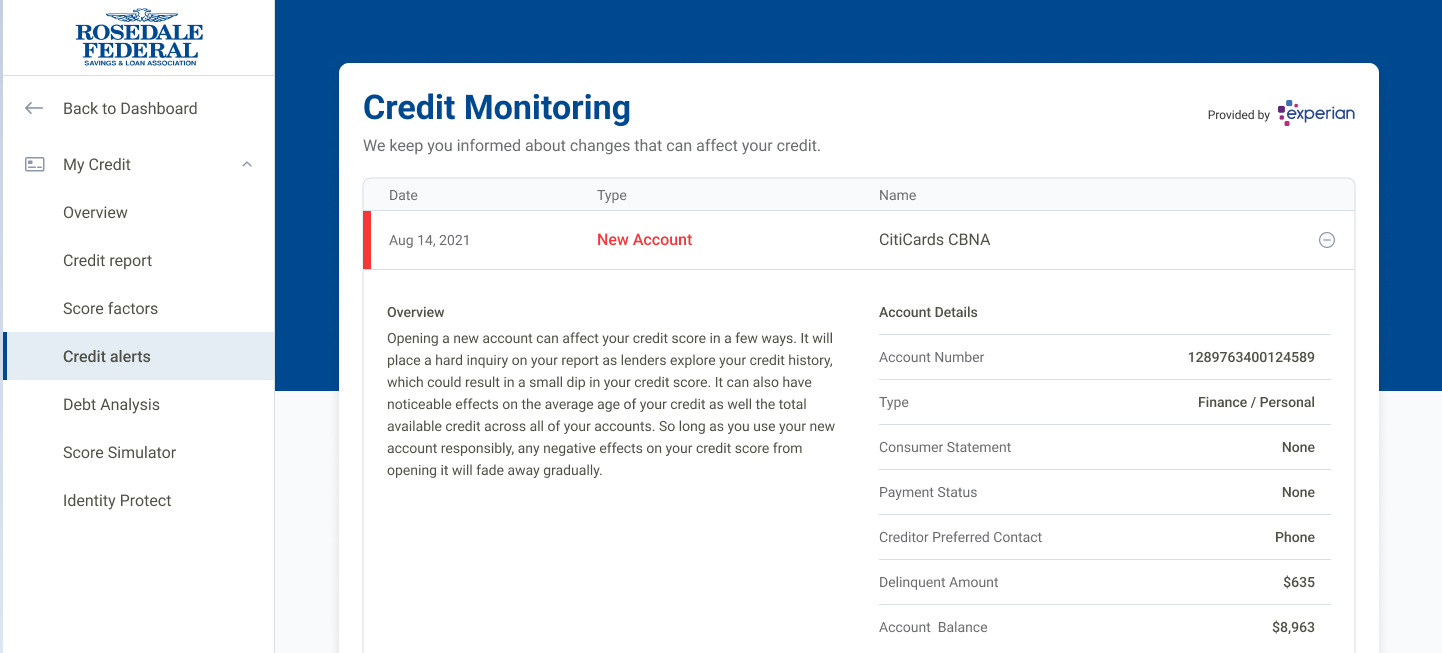

My Credit Manager is FREE and helps you stay in control of your credit score and history with personalized information and educational tools accessible through the Rosedale Federal digital banking experience.

Frequently asked Questions

My Credit Manager Authorization/Enrollment

You understand that by clicking on the "I Accept" button and signing up for My Credit Manager, you acknowledge and agree to the following:

- You are providing "written instructions" under the Fair Credit Reporting Act (FCRA), and other applicable laws, for Experian or any other consumer reporting agency to release your credit report information to Rosedale Federal Savings & Loan Association (“Bank” or “Rosedale Federal”) upon the Bank’s request at any time as long as you are enrolled in the My Credit Manager Service. You understand that My Credit Manager may use your credit information, and other information that you provided prior to, at the time of or after enrollment to confirm your identity, display your credit data to you, and to offer you other Rosedale Federal products and/or services from time to time.

- You acknowledge receipt of a copy of the Rosedale Federal Privacy Notice and that you will retrieve any future copies of the Privacy Notice electronically from the Bank’s website and that the Bank will have no obligation to deliver to you, on an annual basis or otherwise, the then-current Privacy Notice other than through its electronic posting on its website. In accordance with the Privacy Notice and applicable law, Rosedale Federal will use the personal information it obtains about you to fulfill our obligation to provide you with the My Credit Manager service and to offer you other Rosedale Federal products from time to time.

- You agree to the applicable Terms and Conditions for the My Credit Manager service as they may be amended from time to time.

- You understand that you may incur costs, including but not limited to online time and other charges from your communications service provider, in accessing and/or viewing document(s).

My Credit Manager Terms and Conditions

You agree to provide accurate information in your registration and not to share your password with third parties. You agree not to impersonate another person or to select or use a username or password of another person. You agree to notify Experian promptly of any unauthorized use of My Credit Manager and of any loss, theft or disclosure of your password. Failure to comply with these requirements shall constitute a breach of these terms and conditions and shall constitute grounds for immediate termination of your right to access My Credit Manager.

My Credit Manager is a third-party service provided by Array, LLC. The credit score provided is your VantageScore 3.0 Credit Score, which is a model created by the three major credit bureaus, Equifax Inc., Experian Information Solutions, Inc., and TransUnion.

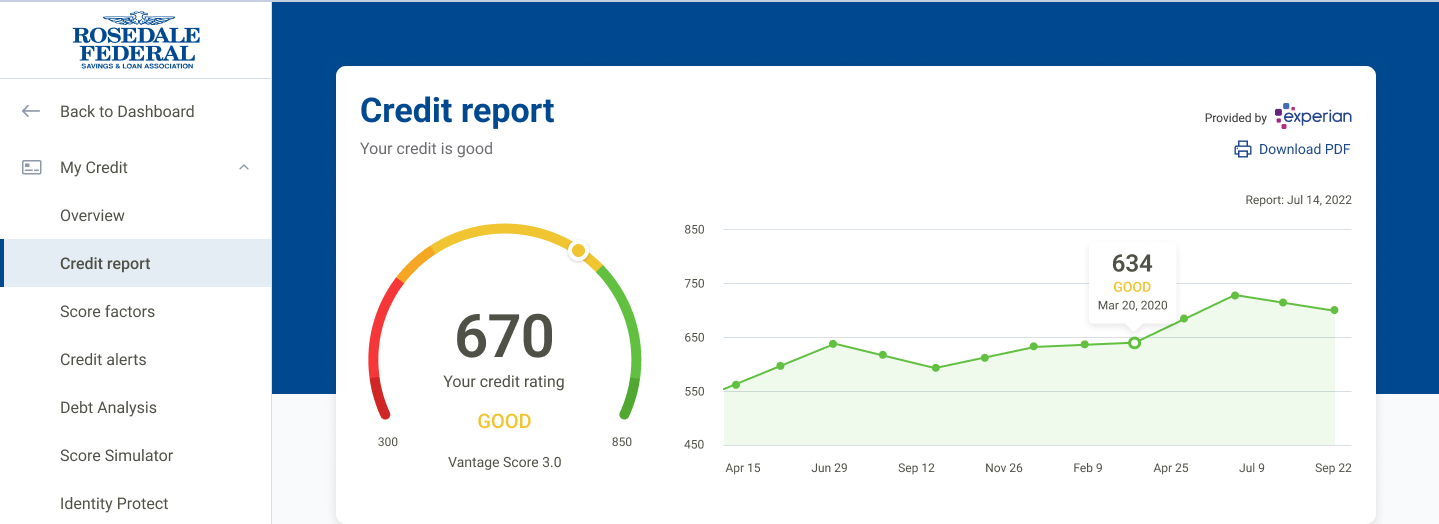

There are many different credit scores in the marketplace based on different models with different scoring ranges. The credit scores provided by My Credit Manager are for educational/informational purposes only. Viewing your credit score through My Credit Manager will not impact your credit score. My Credit Manager can only evaluate the account information that appears on your Experian consumer credit report. Accounts not reported to or subsequently deleted from your Experian consumer credit report will not be reflected in your credit score.

My Credit Manager does not maintain your credit report information and is not able to make any changes to it. Rosedale Federal and Experian are not responsible for inaccurate results, including any due to incorrect, incomplete, or outdated information in your credit report.

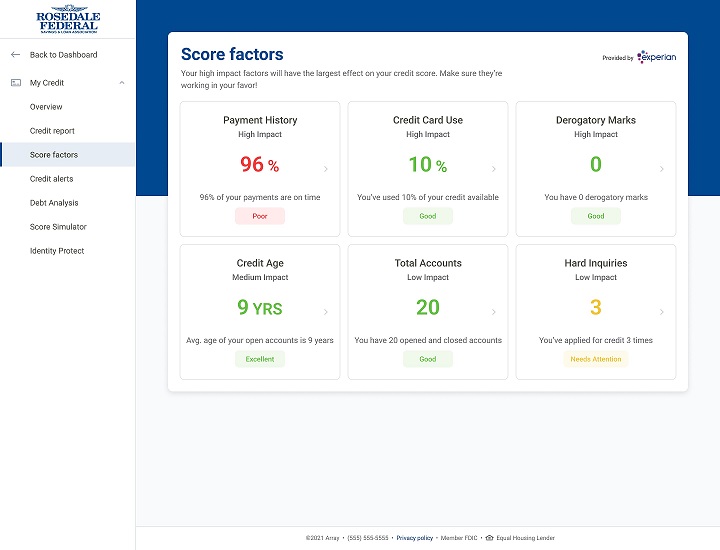

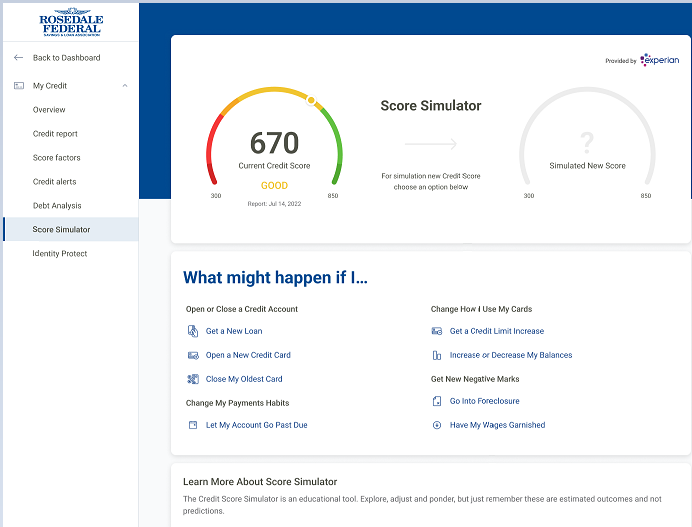

My Credit Manager has certain features that estimate how certain changes in your credit behavior may impact your credit score. These features show how these changes may impact the credit score displayed on My Credit Manager, which is the credit score described above. Simulated credit scores and credit score changes simulated by My Credit Manager are only predicted estimates. My Credit Manager and Experian do not guarantee that your actual credit score will change by the same amount, in the same way, or at all.

My Credit Manager provides you with your credit score described above, related information, and other credit report information. However, it’s important to know that, by law, you also have the right to free credit reports from AnnualCreditReport.com or by calling 877-322-8228, which is the authorized source under federal law for free credit reports. By law, you may obtain one free credit report from each of the three national consumer reporting agencies (Experian Information Solutions, Inc., Equifax Inc., and TransUnion) during any twelve-month period. For more information, go to www.consumerfinance.gov/learnmore.

If you have a Rosedale Federal loan/credit account, any Rosedale Federal account information provided to you as part of My Credit Manager is not the official record of your Rosedale Federal account or its activity. Your Rosedale Federal account statement, furnished to you by us in a paper format, or electronically if you are enrolled in paperless statements service, will remain the official record. My Credit Manager information is generally updated regularly but is subject to adjustment and correction and therefore should not be relied upon by you for taking, or forbearing to take, any action.

My Credit Manager may use your credit information, and other information that you provided prior to, at the time of or after enrollment to confirm your identity, display your credit data to you, and to offer you other Rosedale Federal products and/or services from time to time. You agree that by entering your information and continuing beyond the “I Accept” button, or by otherwise accessing or using My Credit Manager, you permit Rosedale Federal to periodically obtain your credit report to market our products and services to you.

You may terminate your service with My Credit Manager at any time by unenrolling on Rosedale Federal’s website. Your cancellation will be effective after we have a reasonable time to process it. When you cancel, it does not affect the validity of any actions taken by us prior to your cancellation or while we are processing it. We may cancel or amend the terms of the product at any time for any reason.

Except as specifically set forth herein or where the law requires a different standard, neither the bank nor Experian shall be responsible for any loss, damage or injury or for any direct, indirect, special, incidental, exemplary, or consequential damages, including lost profits, arising from or related to the My Credit Manager Service, access to or use of My Credit Manager, any failure of electronic or mechanical equipment/software, or any other problems you experience due to causes beyond our control.

You understand and agree that your use of My Credit Manager is at your sole risk and that the service and all information, products and other content (including third party information, products and content) included in or accessible in/through the service, are provided on an ”as is” “where-is” and “where available” basis, and are subject to change at any time without notice to you.

You agree that the Terms of Use on our website are incorporated into these terms.