Minimum participation size is $500,000.

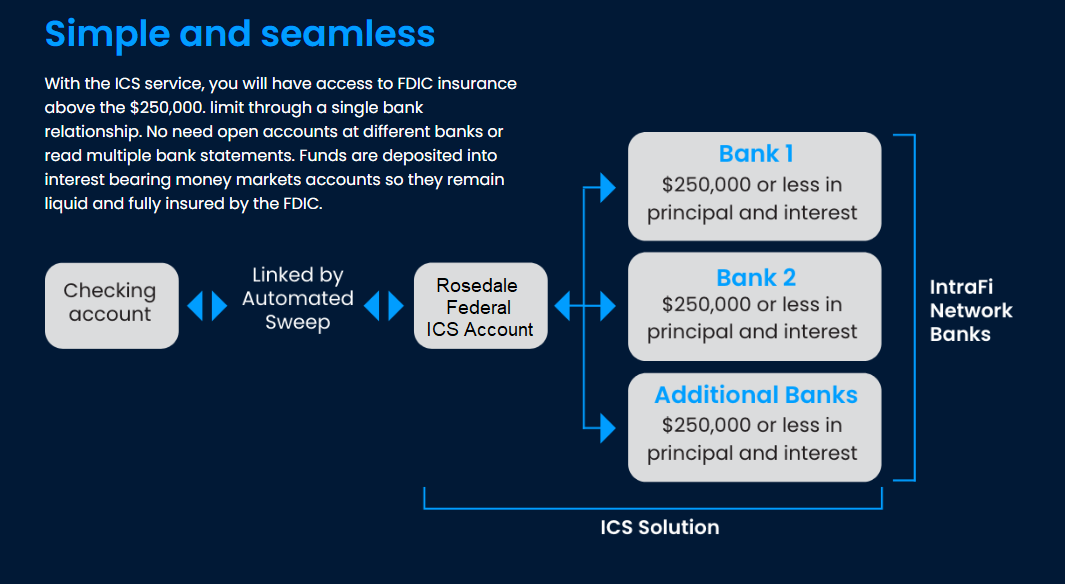

When deposited funds are exchanged on a dollar-for-dollar basis with other banks in the ICS Network, Rosedale Federal as a participating institution can use the full amount of a deposit placed through ICS for lending. Alternatively, with a depositor’s consent to certain types of ICS transactions, the Bank may choose to receive fee income instead of deposits from other banks.

Placement of funds through the ICS service is subject to the terms, conditions and disclosures in the service agreements, including the Deposit Placement Agreement (“DPA”). Limits and customer eligibility criteria apply. Although funds are placed at destination banks in amounts that do not exceed the FDIC standard maximum deposit insurance amount (“SMDIA”), a depositor’s balances at Rosedale Federal may exceed the SMDIA (e.g., before ICS settlement for a deposit or after ICS settlement for a withdrawal).

As stated in the DPA, the depositor is responsible for making any necessary arrangements to protect such balances consistent with applicable law. If the depositor is subject to restrictions on placement of its funds, the depositor is responsible for determining whether its use of ICS satisfies those restrictions. ICS and Insured Cash Sweep are registered service marks of IntraFi Network.

Banking products and services are offered by Rosedale Federal, Member FDIC and Equal Housing Lender

ICS funds are eligible for expanded, multimillion-dollar FDIC insurance of up to $135 million per tax ID for ICS demand and up to $100 million per tax ID for ICS savings. Total available ICS insurance (assuming a client opens both ICS Demand and ICS Savings) is $175 million per tax ID.